Risk Type

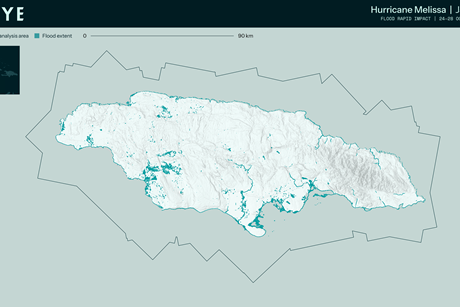

Case study: How radar satellite data transformed crisis response after Hurricane Melissa

When Hurricane Melissa struck Jamaica as a Category 5 storm, satellite-based synthetic aperture radar provided near real-time, countrywide damage intelligence through cloud cover, enabling government and humanitarian teams to prioritise resources, accelerate decision-making and reach the hardest-hit communities faster.

Winter Storm Fern: what a $4–7bn loss event reveals about resilience gaps

Winter Storm Fern shows how freeze risk and power resilience are becoming central risk management issues, even when insured losses remain manageable for the insurance market.

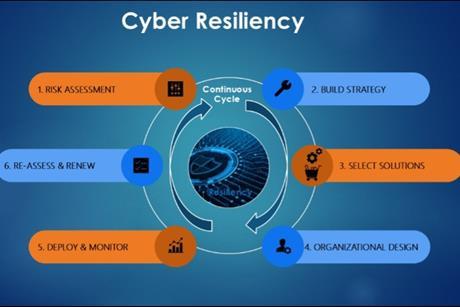

Achieving cyber resiliency – it’s more than the Tech Stack!

Cyber resilience cannot be bought off the shelf. Geoffrey Kerr, cyber security consultant and former VP global cyber security at Procter & Gamble, argues that organisations must move beyond technology-led spending and adopt a risk-based, strategy-first approach that embeds accountability, cultural change and measurable outcomes across the business.

C-suite execs warn of heightened cyber and third-party risks

Operational risks are growing as organisations develop increasingly complicated networks, according to senior executives in a Moody’s survey. Keith Berry, head of corporate and government solutions at Moody’s, explains the findings and steps that may reduce the dangers.

The risk forum 2026: Active disinformation campaign poses risk to the industry, says Dame Susan Langley

Disinformation or misinformation is on the rise globally, according to lady mayor, meaning ‘we have to be far less British’ and better promote London as a business centre to mitigate mistruths

Why converging risks are reshaping the risk agenda in 2026

As climate volatility, liability inflation, cyber exposure and regulatory pressure collide, risk managers are being forced to rethink how risks are identified, governed and defended. New analysis from RiskSTOP shows why integrated resilience is becoming a defining capability for organisations in 2026.

Shock after shock: Why risk leaders say climate resilience models are no longer fit for purpose

The compounding shocks created by climate change were the topic of our latest SR:500 roundtable. Organisations are being forced to reassess their long-held assumptions about resilience, continuity and operational risk as they navigate the road ahead.

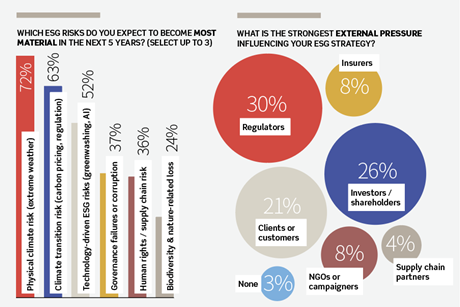

Taking ownership: What risk managers need to change for ESG to stick

True sustainability is more than compliance. Accountability and an ethical mindset are key to lasting change, finds this year’s StrategicRISK ESG Risk Survey, exposing the gap between intention and action.

Dynamic scenario planning that identifies blind spots is key to tackling geopolitical risk

Post-Covid-19, risk managers have had to rethink risk frameworks to shift prediction focus to a preparation mindset, says expert panel

Risk briefing: why geopolitics is becoming central to defence sector growth

Report warns that global defence demand is colliding with fiscal constraints, supply chain fragmentation and structural barriers that are creating significant risks for organisations

Credit outlook 2026: apparent stability masks growing structural risk

Global credit conditions entering 2026 appear stable, but EthiFinance Ratings warns that deeper structural pressures linked to geopolitics, debt affordability and institutional resilience are reshaping risk across corporates, banks and sovereigns.

Regulation watch: Shore power rules force ports to confront infrastructure and risk trade-offs

As EU rules make shore power mandatory, ports are under pressure to deliver on onshore power supply while managing major infrastructure, safety and insurance risks.

Their health in your hands

Employees are demanding more from their healthcare and their benefits. Organisations must now act not just as insurer buyers, but as stewards of workforce wellbeing, while still balancing long-term resilience.

Workplace stress is becoming a systemic risk: What corporate risk managers need to know

As work-related stress claims rise, insurers, regulators and boards are converging on the same question: how well are organisations identifying, evidencing and managing psychological risk?

Country spotlight: Learning from Malaysia renewed focus on risk as a strategic lever

Positioned at the intersection of Southeast Asia’s economic hopes and geopolitical tensions, Malaysia’s attitude to risk is also at a critical juncture. No longer just a compliance checklist, risk management is being seen as a tool to guide strategy and reshape resilience.

When the stabiliser becomes a variable: evaluating the U.S. as a geopolitical threat in 2026

As U.S.political and geopolitical behaviour breaks from decades of predictability, businesses and risk teams face a landscape where stability can no longer be taken for granted.